2016 ACFE Report on Occupational Fraud

Occupational Fraud continues to remain a universal problem faced by all business and government entities against dishonest individuals who have been hired to carry out the organisation’s operations.

Steven Ponsonby, Founding Director of Forensic Accounting QLD advises that fraud is ubiquitous; it does not discriminate in its occurrence and while anti-fraud controls can effectively reduce the likelihood and potential impact of fraud, the truth is that no entity is immune to this threat. Unfortunately, many organisations still suffer from an “it can’t happen here” mindset. To help combat this misconception, to raise public awareness about the cost and universal nature of fraud and to support anti-fraud professionals around the globe, the Association of Certified Fraud Examiners (“ACFE”) undertakes extensive research into the costs and trends related to Occupational Fraud in the form of a survey which is released every two years.

[thrive_2step id=’1249′]Stay Updated[/thrive_2step]

The first “Report to the Nation on Occupational Fraud and Abuse” was published in 1996 to explore the impact of Occupational Fraud and twenty years since the inaugural report was released, the continuing research on these topics now represents the largest collection of occupational fraud cases ever analysed.

Occupational Fraud is defined as:

“the use of one’s occupation for personal enrichment through the deliberate misuse or misapplication of the employing organization’s resources or assets.”

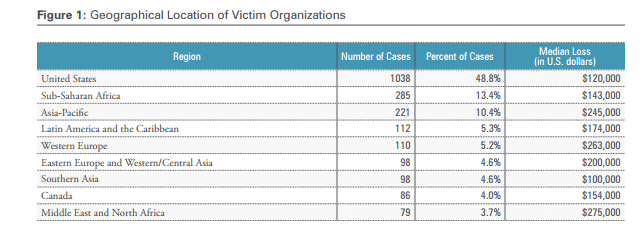

The 2016 report contains an analysis of 2,410 cases of occupational fraud that were investigated between January 2014 and October 2015 across the globe (including 26 cases in Australia) as set out in a table extracted from the report below,

Please note: the Australian cases referred to above included 2 cases (i.e. 8%) that were investigated by Forensic Accounting, refer to our Blogs on Woltmann and Ransley for further details.

The frauds occurred in 114 countries on six continents, (including Australia) and offer readers an interesting insight into the global nature of occupational fraud.1

Whilst, the full report can be accessed here, we have set out a summary of the report’s major findings below for your information:

- Organisations lose an estimated 5% of total revenue to fraud each year.

- The median loss caused by occupational fraud is $150,000, ($ ⇑ on the 2014 survey).

- More than 23.2% of the reported losses exceeded $1 million, (% ⇑ on the 2014 survey).

- The frauds had been undertaken for an average of 18 months before being detected, (no change on the 2014 survey).

- Frauds that had lasted more than 5 years had a medium loss of $850,000.

- In 94.5% of the cases in our study, the perpetrator took some efforts to conceal the fraud. The most common concealment methods were creating and altering physical documents.

- Asset misappropriation schemes were by far the most common type of occupational fraud, comprising 85% of the cases reported with a medium loss of $130,000).

- Financial statement fraud schemes represented 10% of the cases in the study, but caused the greatest median loss at $975,000.

- Occupational fraud is more likely to be detected by a tip off than by any other method.

- Occupational fraud is a significant threat to small businesses (i.e. those with < 100 employees)– suffering a similar percentage to an organisations with greater than 10,000 employees, however the economic impact on a small business will be disproportionally larger.

- Fraud perpetrators tended to display behavioral warning signs when they were engaged in their crimes.

- 56.8% of matters were referred to the authorities and a total of 85.4% either plead guilty and/or were convicted at trial, which represents a slight improvement over 2014.

The ACFE is the world’s largest anti-fraud organization and premier provider of anti-fraud training and education. Together with nearly 75,000 members, the ACFE is reducing business fraud world-wide and inspiring public confidence in the integrity and objectivity within the profession. Please refer to www.acfe.com for further information on the ACFE.

1 Note: the number of cases in each region largely reflects the demographics of ACFE membership, as that is the source of our data which should not be interpreted to mean that occupational fraud is necessarily more or less likely to occur in any particular region.